Best 30 Loans Home Equity in Kalispell, MT with Reviews

To determine your LTV ratio, divide all current and prosed loan amounts by the value of the home, and then multiply by 100 to get a percentage. During the term of the loan, you can draw on your available balance, which is the maximum limit minus the principal balance. There is no limit to the number of draws or minimum draw amount.

Contact one of our outstanding loan officers to personally guide your journey, step by step. Janice was very helpful and made our house buying experience very easy and stress free. Mann Mortgage is a family-owned company that emphasizes honesty, integrity, and community.

Construction Loan

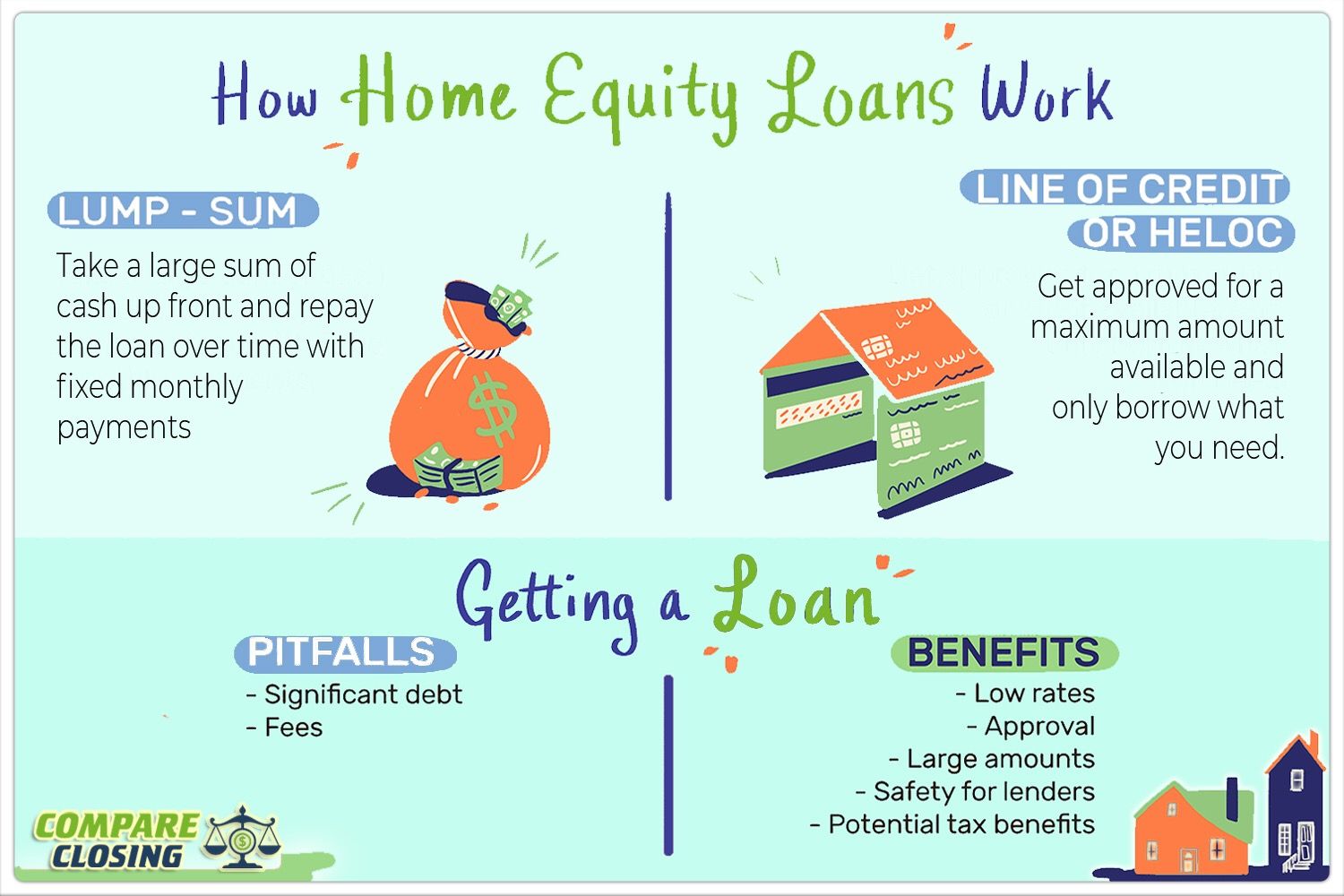

With a construction loan from Mann Mortgage, you’ll gain access to our collaborative, cloud-based construction loan software, which simplifies communication between you, the builder, 3rd-party inspectors, and title companies. You also get full-time support and real-time tracking for the construction phase of your financing through the building process, to ensure you stay on budget and on time with your construction loan. A reverse mortgage, or Home Equity Conversion Mortgage , is a type of home loan available to homeowners 62 or older who have considerable equity (usually at least 50%) in their home. This financial tool can benefit people who need additional cash flow for other expenses, as the value of their home’s equity can be converted to cash, eliminating monthly mortgage payments. Borrowers use the equity in their home as security for the loan, and can receive funds as monthly payments, a line of credit, or in a lump sum. This is called a "reverse" mortgage, because in contrast to a traditional mortgage, the lender makes the payments to the borrower.

YP advertisers receive higher placement in the default ordering of search results and may appear in sponsored listings on the top, side, or bottom of the search results page. A Veterans Affairs loan, is designed to offer long-term financing to qualified American veterans, service members, and their eligible surviving spouses. These loans are insured by the United States Department of Veterans Affairs. You may be able to borrow up to 90% of your home's appraised value. Fixed rate home equity loans are provided as a one-time lump sum disbursement, either transferred to your account or as a cashier's check when loan is funded. Get in gear with the right loan for vehicles of all ages and terms to suite your needs.

West One Bank

Mann Mortgage has been helping home buyers turn their dream of homeownership into reality for 30 years. We offer a variety of home loan solutions, including FHA, VA, Conventional, FHA 203k financing, USDA, low FICO loan options, investor loans, first time home buyer loans and more. Please select a loan type from the options below to learn more. Our team of Montana mortgage brokers, originators and processors at FVM realize what it means to live the dream in Northwest Montana. We want to make sure that borrowers of all walks of life get to experience the beauty that is the Flathead Valley. We're here to help whether you're a first-time home buyer, wanting to buy the perfect vacation home getaway, or looking to add an investment property to your portfolio.

Earn competitive dividend rates with the comfort of knowing your money is secure. We had a difficult loan involving several principals and got the loan we needed to go forward with the purchase. Jumbo loans refer to loans of a larger amount, roughly $647K and up in Montana. Let Flathead Valley Mortgage make your home loan experience be a comfortable one. Your HELOC is a 10 year interest only loan, with a 10 year draw period and a Balloon payment. The principal and any accrued interest is due in full on your maturity date.

Apply

Bay Equity Home Loans remains open for business and serving the needs of our borrowers. As a full-service mortgage lender, we can help with whatever your home loan needs may be. FHA loans are excellent loans for first-time home buyers or and those who do not want to bring in a large down payment. Interested in hearing about some of the newest loan options available from lenders? Matt Rizzolo recently sat down with Janet Cantrell of Montana Radiant Realty to discuss new home loan options for 2022.

We offer competitive rates and flexible terms to ensure you get the best auto loan financing in Montana. Conventional loans are a more traditional type of home loans involving 5% or more down payment. If you’re purchasing a property in a rural area, you may be eligible for a United States Department of Agriculture guaranteed loan . This financing option is available for home buyers with low to moderate income. Our competitive rates are based on credit eligibility at the time of application. Loan to value is a ratio used by lenders to determine available equity based on the appraised market value minus current or proposed outstanding debt on the subject property.

Kalispell Branch Location

The Flathead Valley Mortgage team now consists of Matt Rizzolo, Adelina Hanson and Regis Dahl. Our new office sits at 729 Nucleus Ave, Unit D in Columbia Falls, MT. All of our mortgage brokers are long time residents of the Flathead Valley and we welcome new and existing residents of Montana into our office. Choose between a fixed rate home equity loan or a variable rate home equity line of credit. After years of mortgage payments, you may have accumulated considerable equity in your home. Whether you are buying or refinancing, buying your first home or building your dream home, we can help you explore the many options for financing. Bay Equity is a full-service mortgage lender that prioritizes personal relationships.

A revolving source of funds, much like a credit card, that you can access as you choose. Get more flexibility from your home loan, with as little as 5% down and no mortgage insurance requirement. Use the calculator links below to help plan your home purchase or refinance.

Flathead Valley Mortgage is a leader in home loan origination, refinancing & debt consolidation for mortgage lending. An upfront lump sum of cash, with a fixed payments over the life of the loan. Loans for Veterans, with low interest rates & expanded guidelines for making it easier to secure financing. Matt Rizzolo has been a Whitefish mortgage broker for over 4 years and recently built relationships with great professionals in loan origination.

YP - The Real Yellow PagesSM - helps you find the right local businesses to meet your specific needs. Search results are sorted by a combination of factors to give you a set of choices in response to your search criteria. “Preferred” listings, or those with featured website buttons, indicate YP advertisers who directly provide information about their businesses to help consumers make more informed buying decisions.

For a Fixed Rate Term Home Equity Loan, the payment is calculated based on loan amount, interest rate, and term of the loan. This payment would remain same through term of loan assuming no late payments or modification to loan terms or balance. With our constantly changing housing and mortgage markets, we can help you navigate the many options to find the right loan to fit your family, your needs and your financial circumstances. We understand the home loan process can be daunting, so we’re here to support you all the way through. From a home loan to a home refinance, we’re proud to offer a secure application process that you can easily complete on your smartphone or computer.

A home renovation loan is a type of mortgage designed to finance both the purchase and renovation of a fixer-upper home at the same time, or to fund home repairs, additions, and more. Unlike traditional mortgages, the renovation loan’s interest rate is based on the value of the home after renovation is complete, allowing homeowners to tap into future equity to get the lowest interest rate possible. With a renovation loan from Mann Mortgage, you’ll gain access to our collaborative, cloud-based construction loan software, which simplifies communication between you, the builder, 3rd-party inspectors, and title companies. Mann Mortgage is proud to offer stick-built contruction loans, which give borrowers a better option for building the home of their dreams.

Comments

Post a Comment