AUTUMN MCLEAN BAY EQUITY HOME LOANS Request Information 807 Spokane Ave, Whitefish, MT

Table of Content

We work with preferred lenders to offer great rates & quick closings. Flathead Valley mortgage clients come from all walks of life and extend not only to Northwest Montana, but all over Big Sky Country. We’ve helped clients with purchase and refinance loans in Columbia Falls, Kalispell, & Whitefish, along with the surrounding areas of Bigfork, Hungry Horse & West Glacier. We are also licensed to originate loans throughout the entire state of Montana. We offer a wide variety of lending options and pride ourselves in being able to pair the right product with our customers. We will help to explain the benefits and challenges of each program available to you.

Mann Mortgage has been helping home buyers turn their dream of homeownership into reality for 30 years. We offer a variety of home loan solutions, including FHA, VA, Conventional, FHA 203k financing, USDA, low FICO loan options, investor loans, first time home buyer loans and more. Please select a loan type from the options below to learn more. Our team of Montana mortgage brokers, originators and processors at FVM realize what it means to live the dream in Northwest Montana. We want to make sure that borrowers of all walks of life get to experience the beauty that is the Flathead Valley. We're here to help whether you're a first-time home buyer, wanting to buy the perfect vacation home getaway, or looking to add an investment property to your portfolio.

USDA RD Loan

We offer competitive rates and flexible terms to ensure you get the best auto loan financing in Montana. Conventional loans are a more traditional type of home loans involving 5% or more down payment. If you’re purchasing a property in a rural area, you may be eligible for a United States Department of Agriculture guaranteed loan . This financing option is available for home buyers with low to moderate income. Our competitive rates are based on credit eligibility at the time of application. Loan to value is a ratio used by lenders to determine available equity based on the appraised market value minus current or proposed outstanding debt on the subject property.

YP advertisers receive higher placement in the default ordering of search results and may appear in sponsored listings on the top, side, or bottom of the search results page. A Veterans Affairs loan, is designed to offer long-term financing to qualified American veterans, service members, and their eligible surviving spouses. These loans are insured by the United States Department of Veterans Affairs. You may be able to borrow up to 90% of your home's appraised value. Fixed rate home equity loans are provided as a one-time lump sum disbursement, either transferred to your account or as a cashier's check when loan is funded. Get in gear with the right loan for vehicles of all ages and terms to suite your needs.

Conventional Loans

Borrowers can enjoy peace of mind when using our premier lenders, ensuring low monthly payments and quicker closing times. Chartered in 1934, Whitefish Credit Union is the largest credit union in Montana with over $2 billion in assets. Bank online or visit one of our conveniently located branches in Columbia Falls, Eureka, Kalispell, Polson, South Kalispell, Thompson Falls or Whitefish, MT. A Federal Housing Administration loan is insured by a government agency called the Federal Housing Administration, and offers financing to borrowers who may not be able to qualify for traditional loans. This loan is popular among first-time home buyers and those with less-than perfect credit, as it requires smaller down payments and feature more flexible terms. Flathead Valley Mortgage brokers have an exceptional history of helping home buyers secure the best available home loans.

Since our founding in 1989 by Don Mann, we've been committed to helping borrowers like you find the best loan and fulfill the dream of home ownership. If you’re looking for a loan that exceeds the standard conforming limit of $417,000, you may need to look into a Jumbo loan. This option is typically used to buy that higher-priced luxury home.

Questions & Answers

A home renovation loan is a type of mortgage designed to finance both the purchase and renovation of a fixer-upper home at the same time, or to fund home repairs, additions, and more. Unlike traditional mortgages, the renovation loan’s interest rate is based on the value of the home after renovation is complete, allowing homeowners to tap into future equity to get the lowest interest rate possible. With a renovation loan from Mann Mortgage, you’ll gain access to our collaborative, cloud-based construction loan software, which simplifies communication between you, the builder, 3rd-party inspectors, and title companies. Mann Mortgage is proud to offer stick-built contruction loans, which give borrowers a better option for building the home of their dreams.

Reliable, personal service from a mortgage expert who will go above and beyond to help you buy a home. You could be eligible for a down payment as low as 3% for a range of borrowers and credit scores. Fees, including appraisal and title, range from $350 to $5,000.

With a construction loan from Mann Mortgage, you’ll gain access to our collaborative, cloud-based construction loan software, which simplifies communication between you, the builder, 3rd-party inspectors, and title companies. You also get full-time support and real-time tracking for the construction phase of your financing through the building process, to ensure you stay on budget and on time with your construction loan. A reverse mortgage, or Home Equity Conversion Mortgage , is a type of home loan available to homeowners 62 or older who have considerable equity (usually at least 50%) in their home. This financial tool can benefit people who need additional cash flow for other expenses, as the value of their home’s equity can be converted to cash, eliminating monthly mortgage payments. Borrowers use the equity in their home as security for the loan, and can receive funds as monthly payments, a line of credit, or in a lump sum. This is called a "reverse" mortgage, because in contrast to a traditional mortgage, the lender makes the payments to the borrower.

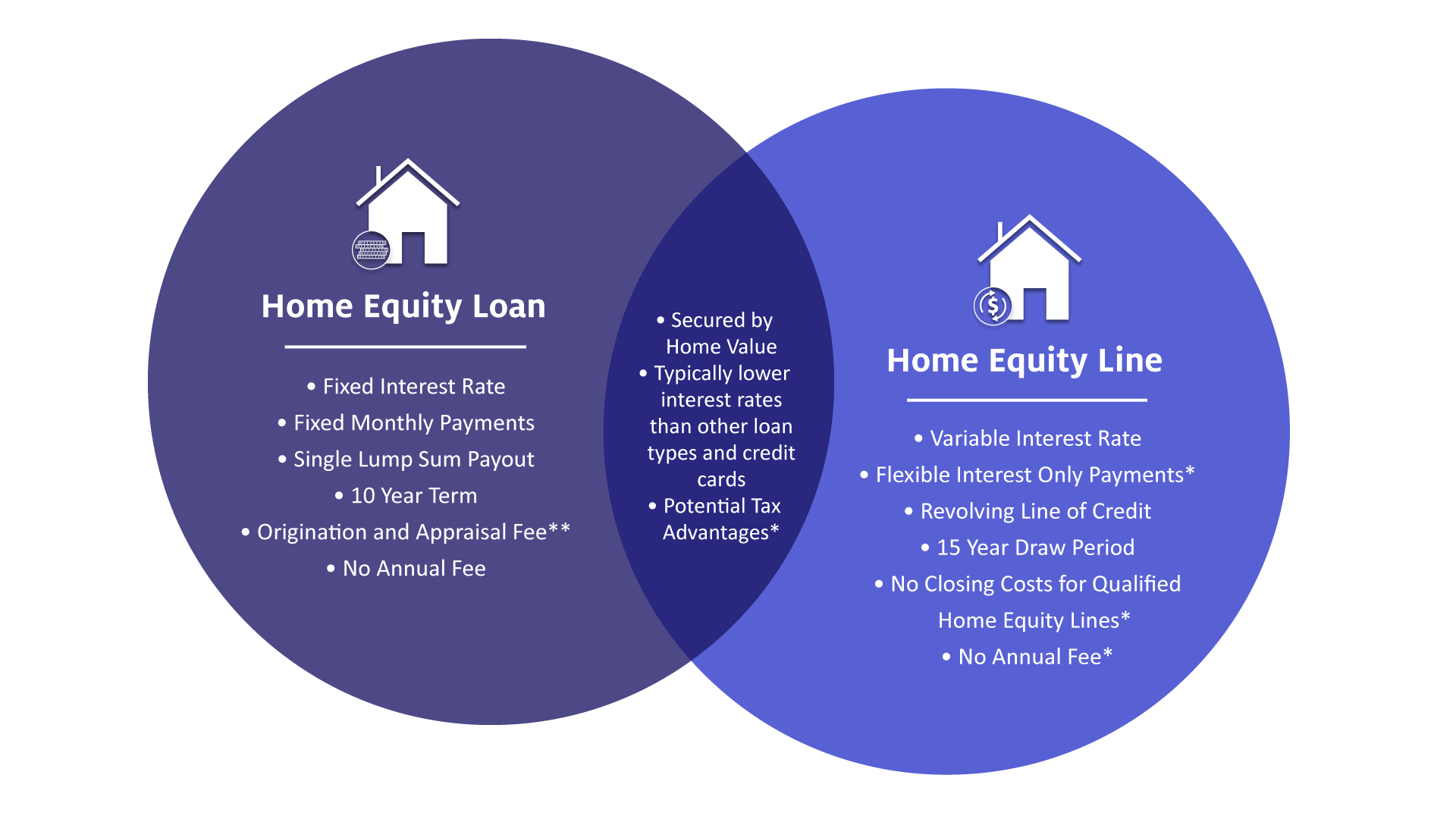

For the past 3 years we've been assisting homebuyers with their new home purchases in Whitefish, Columbia Falls, Kalispell, Bigfork, and the greater Flathead Valley area. A conventional loan is available in a variety of loan term options and is advantageous for those coming in with a strong down payment and good credit history. This loan type is not insured by a government program such as FHA or VA. Whitefish Credit Union lets you borrow against that equity through a Home Equity Loan or Home Equity Line of Credit with competitively low interest rates. From major home improvements to large expenses to debt consolidation, we have options to help you meet your goal. These products are often low-cost alternatives to high-interest consumer loans and credit cards.

Contact one of our outstanding loan officers to personally guide your journey, step by step. Janice was very helpful and made our house buying experience very easy and stress free. Mann Mortgage is a family-owned company that emphasizes honesty, integrity, and community.

Flathead Valley Mortgage is a leader in home loan origination, refinancing & debt consolidation for mortgage lending. An upfront lump sum of cash, with a fixed payments over the life of the loan. Loans for Veterans, with low interest rates & expanded guidelines for making it easier to secure financing. Matt Rizzolo has been a Whitefish mortgage broker for over 4 years and recently built relationships with great professionals in loan origination.

Comments

Post a Comment